… by Viktor Mikhin, with New Eastern Outlook, Moscow

[ Editor’s note: Viktor Mikhin takes us on a tour of how the Saudis may have opened a Pandora’s box which will come back to haunt it, and soon. VT readers are already versed on the US and Saudi plan to lower oil prices as a crunch on the Russian economy, while the US attacks via its Ukraine coup government proxy.

This move had other designs, like taking the wind out of the funding available for Russia’s long overdue military modernization — a situation which grew out of Moscow’s investing more into trade infrastructure with the goal of reducing the emergence of military threats. Businesses historically have not found shooting their customers to have any long term benefits.

We can see that Russia’s emerging commercial success is what the special interests in the US and EU began to see as a threat, and even more so, as their self-looted economies teetered on the brink of keeping their house of cards structures from collapsing. Like a galactic black hole, they must continue to devour to exist.

As the West throws off its former assurances that the old Soviet states would not be absorbed into a Western military block, we now see the march to bring that gun barrel closer to Russia’s head. As Russia’s top defense strategist has stated, one of the mid-term goals for the US and EU is to move their anti-missile system into eastern Ukraine.

It could then theoretically shoot down a Russian retaliatory strike while its missiles were ascending, after a preemptive strike by the West. Such a move is a huge aggressive threat escalation in peacetime.

The Saudis also wanted to choke of the shale oil threat, not just due to loss of market share, but not wanting to lose the US being dependent on it for a secure energy supplier. I sense there have been major talks toward replacing Russian energy imports for Europe with those from US Gulf Allies, which is the real reason Assad had to go.

Syria has huge offshore energy deposits, and the geo-maps showing the fields hitting the Syrian northern coastline have been suppressed. Those huge deposits will not be “discovered” until after Syria has been Balkanized and new owners established in that area. Then we would see a pipeline built to the EU in a jiffy.

I was mystified though by Viktor’s thinking that Yemen’s potential threat of closing off the Bab-el-Mandeb Strait to cut off Persian Gulf oil exports to Europe was a stretch, with Iran as the bogeyman again. Such an act would violate a number of free navigation of the seas laws and trigger full international sanctions on Yemen in a heartbeat.

The EU, NATO and Egyptian naval forces would have no problem at all keeping it open, and any thought of Iran’s using its Navy to close it is ludicrous. Its navy is far too valuable in protecting Iran from preemptive strikes to waste on such a silly adventure.

But I agree with his estimation that, if Iran can bring a million more barrels of oil a day into the market by 2016, it could push prices down another $10 per barrel. Of course, finding customers is not an assumed item. Financially hard-pressed oil and gas consumers would all be the main beneficiary from this, and it could be what might save Britain and Europe from much worse circumstances.

One man’s loss is another man’s gain; and no one plays fair when it comes to others taking the pain. And if there is a war over it, then everyone gets to share… Jim W. Dean ]

______________________

First published … August 23, 2015

Saudi Arabia, as facts and speeches of members of the Saudi government suggest, has declared merciless war on companies extracting shale oil in the United States. According to Saudi newspaper Al Jazirah, Saudi Arabia will play for a fall in world oil prices until these producers as well as other competitors leave the world oil market.

In other words, the Saudis will make every effort to ensure shale oil, oil extracted from bituminous sands and offshore projects around the world bring no profit, and in doing so, will try to destroy its rivals and dominate the world oil market. Here is what objective reality looks like, though: since the production of shale oil in the United States is on the rise, the country can exercise a more relaxed financial policy.

The Saudis cannot manipulate the production of shale oil in any way; all they can do is try to knock the prices down. So far, this is the only strategy that Saudi Arabia can adopt. On the one hand, the position of the Saudi rulers is understandable. After all, not only is the cost of oil extraction the lowest ($ 4-5) in Saudi Arabia, but it also has the most convenient system of oil shipment since all the ports are located in the immediate vicinity of the oil drilling sites.

Owing to these facts and to the high oil prices of the past years, Saudi Arabia, as is noted by the financiers, is financially stable, and has accumulated very large reserves, which can be used to replenish its current budget and thereby compensate for the losses incurred by falling oil prices.

According to Saudi Minister of Petroleum and Mineral Resources Ali al-Naimi, lower prices in the short term will lead to higher prices in the long run because of reduced investments in the sector.

Of course, he was speaking, primarily, about the United States. Officials of the Kingdom also expressed confidence that the country’s substantial foreign exchange reserves would help counter the effects of falling oil prices.

Keeping prices low for some time seems to be a good idea, as the producers of expensive oil will be squeezed from the market, production will shrink and prices will recover.

In these circumstances, a revival of the oil shale industry in the United States may not take place at all, which will ensure long-term balance in the market. At the same time, Saudi Arabia would be able to maintain its market share and customers, and as for the loss, they could be compensated fairly quickly.

But, on the other hand, there are some negative trends that Saudi analysts had failed to timely forecast. The situation has developed according to the famous saying, “Do not dig a ditch for another, you might fall into it yourself.” Lately, due to some strategic changes in the oil market, oil production can no longer be manipulated to slow down, triggering the consequent increase of oil prices.

“The only thing OPEC can do is to reduce production,” says Tim Cullen, Representative of the International Monetary Fund in Saudi Arabia. “But we must remember if OPEC reduces production, then shale oil producers from the United States will replace them. What’s the point for them to lose the market? Right now, there is no strict correlation between oil prices and the volume of its production. That ended when oil became a commodity. It is more about financial history than the balance of supply and demand.”

Has the Saudi Royal family extended its stay?If Saudi Arabia’s 2014 budget, where the oil production sector accounted for 90% of the country’s budget revenues, was prepared based on $ 103 per barrel, in 2015 the budget was based on $ 80 per barrel. Earlier, the Saudi Ministry of Finance said that the planned expenditures would amount to 860 billion riyals ($ 229 billion) in 2015, which is the same as in 2014.

However, the country’s income in the current year amounted to only 715 billion riyals, while in 2014 it was 1.05 trillion riyals. As a result, the budget deficit in the Kingdom may reach 20% of GDP, or $ 140 billion this year.

Reduced oil revenues forced the Saudi authorities to issue two series of government bonds in a row this summer. The first was issued in the total amount of $ 4 billion, the second—$ 5.3 billion. As a result, the state can earn about $ 27 billion by the end of the year. Until recently, Saudi Arabia managed to compensate for the losses by resorting to the state financial reserves. Since August 2014 and until today, the government has used $ 65 billion of its reserves. By now, the amount of state reserves has reduced to $ 672 billion.

Many analysts believe that Saudi Arabia plans to continue pursuing its own strategy in the future. Despite the catastrophic decrease in oil revenues, Riyadh is not going to cut government spending and will continue to subsidize health care and education. Tim Cullen believes that the Kingdom will maintain a high level of spending despite the fact that available in the “piggy bank” $ 672 billion can quickly dry up, even if austerity measures are taken.

Interestingly, the oil policy, or rather the economy, forced the Saudis to actively intervene in the dispute in their neighboring country, Yemen. First, by bombing the Yemeni territory, and then by dispatching its troops across the border. So, what kind of prize could persuade King Salman, known for his prudence and diligence, to take such risks? Apparently, the reasons must be very important.

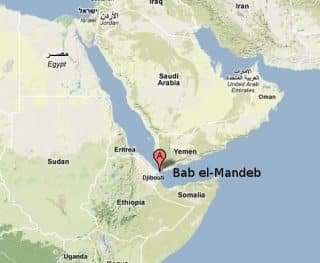

It’s all about the geographical location of Yemen, which controls the Bab-el-Mandeb Strait—the southern gate to the Red Sea and strategic transportation route for shipment of Middle Eastern oil to Europe.

The Bab-el-Mandeb Strait is only 18 miles (slightly less than 29 kilometers) at its narrowest point. There are only two corridors—two miles (3.2 km) each—available for sailing: one for the passage from the Red Sea into the Gulf of Aden and the other—in the opposite direction.

Closure of the Strait will stop the movement of oil tankers from the Persian Gulf to the Suez Canal and the SUMED pipeline in Egypt. All cargo would have to be redirected to the Cape of Good Hope and then around Africa. Daily, 3.8 million barrels of oil are transported through the Strait to Europe and North America. A detour would significantly increase the transportation cost component of oil prices.

For example, the route to North America would be 2,700 miles longer; the number of annual trips would fall from 6 to 5 per tanker, and the cost of extra fuel, required for shipment of oil around Africa, would amount to $US 3.5 million per year. In addition, the shortest route for the delivery of North African oil to the Asian markets is also through the Bab-el-Mandeb Strait, which would not be something the Saudis would have to worry about.

So, “the Saudis have embarked on war,” makes a straightforward statement Indian newspaper the Hindustan Times, “to maintain control over the Bab-el-Mandeb Strait.” The Riyadh’s current paradigm is such that it will continue struggling with Shiite Iran for the hegemony in the region. In part, this is true: Tehran does actually seek domination in the Middle East and uses local fellow Shiites as its policy conductors in the region.

This is where fears of Saudi Arabia stem from (it also considers itself the hegemon in the Arab world). Indeed, pro-Iranian regimes are spreading rapidly: Damascus (Alawites), Beirut (Hezbollah), Baghdad and now Sana.

It seems that lately King Salman has been haunted by the same nightmare: Iran “blocks” the Bab-el-Mandeb Strait and the Straits of Hormuz as well as the land transit of oil through Syria.

In addition, according to the World Bank, after the lifting of international sanctions against Iran and its full return to the world market, sales of oil will increase by about one million barrels per day. As a result, experts say, the next year the price of oil will decline by another $ 10 per barrel, or about 21 percent of the current level.

And thus, it will be no longer the omnipotent oil magnate Riyadh, but a new center of the “black gold” that will rule the roost.

It is possible that under these new conditions, the so-called “oil blitzkrieg” thoroughly elaborated by the Saudis will have no effect, and Saudi Arabia itself will suffer a crushing defeat on all fronts. If you take into account Washington’s cooling friendship with its former strategic partner, this scenario would appear viable.

The current administration of Barack Obama is most likely guided by the principle of the British Foreign Secretary and Prime Minister Viscount Henry John Temple, Lord Palmerston, who on March 1, 1858 said in parliament regarding the British foreign policy:

“We have no eternal allies, and we have no perpetual enemies. Our interests are eternal and perpetual, and those interests it is our duty to follow.”

Victor Mikhin, Corresponding Member of the Academy of Natural Sciences, exclusively for the online magazine “New Eastern Outlook.”

____________

Jim W. Dean was an active editor on VT from 2010-2022. He was involved in operations, development, and writing, plus an active schedule of TV and radio interviews.

ATTENTION READERS

We See The World From All Sides and Want YOU To Be Fully InformedIn fact, intentional disinformation is a disgraceful scourge in media today. So to assuage any possible errant incorrect information posted herein, we strongly encourage you to seek corroboration from other non-VT sources before forming an educated opinion.

About VT - Policies & Disclosures - Comment Policy