[ Editor’s note: William Engdhal revisits his American shale oil Ponzi scheme theme that he has been writing about for some time now.

The Saudi move to push oil prices down as another financial flank move on the Russians to make them more malleable to Western geopolitical intrigues was a basket of boomerangs.

The biggest of those could end the oil shale boom in the US, which has been fed by low-interest loan money to front shale oil drilling, which has become a scramble to keep up the production for two reasons — the wells peter out quickly and the easy access fields have already been worked.

As prices go down, production costs go up, and lenders fear to continue supplying the cash, then we could see a sharp decline with America trending back toward importing. The Saudis could theoretically dial back their downward-pricing pressure, but there are some critical problems with that.

While the major producers are always concerned about getting good prices, they are more worried about maintaining market share, and those with big reserves and deep pockets can price cut deeper and longer as long as they can hold market share.

The Saudis have also led the way on the price cutting out of concerns of Iran’s production going up substantially after the sanctions, when foreign capital will speed up the development of their oil and gas reserves. As William closes in his article below, we will probably only have to wait a few months to see how this will turn out… Jim W. Dean ]

– First published … November 6, 2014 –

by F. William Engdahl, with New Eastern Outlook, Moscow

By now even the New York Times is openly talking about the secret Obama Administration strategy of trying to bankrupt Russia by using its oil-bloated Bedouin bosom buddy, Saudi Arabia, to collapse the world price of oil.

However, it’s beginning to look like the neo-conservative Russia-haters and Cold War wanna-be hawks around Barack Obama may have just shot themselves in their oily foot.

As I referred to it in an earlier article, their oil price strategy is basically stupid. Stupid — as all consequences have not been taken into account. Take now the impact on US oil production as prices plummet.

The collapse in US oil prices since September may very soon collapse the US shale oil bubble and tear away the illusion that the United States will surpass Saudi Arabia and Russia as the world’s largest oil producers. That illusion, fostered by faked resource estimates issued by the US Department of Energy, has been a lynchpin of Obama’s geopolitical strategy.

The collapse in US oil prices since September may very soon collapse the US shale oil bubble and tear away the illusion that the United States will surpass Saudi Arabia and Russia as the world’s largest oil producers. That illusion, fostered by faked resource estimates issued by the US Department of Energy, has been a lynchpin of Obama’s geopolitical strategy.

Now the financial Ponzi scheme behind the increase of US domestic oil output the past several years is about to evaporate in a cloud of fictitious smoke. The basic economics of shale oil production are being ravaged by the 23% oil price drop since John Kerry and Saudi King Abdullah had their secret meeting near the Red Sea in early September to agree on the Saudi oil price war against Russia.

Wall Street bank analysts at Goldman Sachs just issued a 2015 forecast that US oil prices, measured by a benchmark called WTI (West Texas Intermediate) will fall to $70 a barrel. In September 2013, WTI was more than $106 a barrel. That translates into a sharp 34% price collapse in just a few months.

American shale oil production – a Ponzi scheme

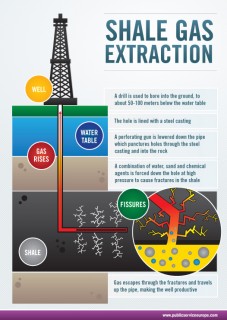

Why is that critical to US shale production? Because, unlike conventional crude oil deposits, shale oil or tight oil as the industry calls it, depleted dramatically faster.

A comprehensive new analysis just issued by David Hughes, a Canadian oil geo-scientist with thirty years’ experience with the Geological Survey of Canada, using data from existing US shale oil production that has now become public for the first time (the shale oil story is very recent), shows dramatic rates of oil volume decline from US shale oil wells:

The three-year average good decline rates for the seven shale oil basins measured for the report range from an astounding 60 percent to 91 percent.

That means over those three years, the amount of oil coming out of the wells decreases by that percentage. This translates to 43 percent to 64 percent of their estimated ultimate recovery dug out during the first three years of the well’s existence.

Four of the seven shale gas basins are already in terminal decline in terms of their good productivity: the Haynesville Shale, Fayetteville Shale, Woodford Shale, and Barnett Shale. A decrease in oil daily of between 60% and 91% for these best possible shale oil regions means the oil companies must drill deeper to even stay still with oil production, let alone increase total oil volume.

That means the drillers must spend more money to drill deeper, a lot more. According to Hughes, the Obama Administration Department of Energy has uncritically taken rosy forecast numbers given them by the companies that boost the US shale oil myth. His calculations show future US shale oil output is only 10% that is estimated for 2040 by the Energy Department.

Hughes describes the current deadly dilemma of the shale oil companies as a “drilling treadmill.” They must drill more and more wells just to keep production levels flat. The oil companies have already gone after the most promising shale oil areas, so-called “sweet spots,” to maximize their production.

Now as production begins to decline terminally, they must start drilling in spaces with less rich oil and gas returns. He adds, “if the future of U.S. oil and natural gas production depends on resources in the country’s deep shale deposits… we are in for a big disappointment.”

Oil price collapse

What Hughes describes as the state of shale oil before the start of the Kerry-Abdullah Saudi oil price war. Now US WTI oil prices have dropped a catastrophic 25% in six weeks, and still falling.

Other large oil producers like Russia and Iran are in turn flooding the world market with their oil to increase revenue for their state budgets, adding to a global oil supply glut. That in turn pressures prices more.

The shale oil and gas bonanza of the past five years in the USA has been built on a foundation of zero Federal Reserve interest rates and huge speculative investment by hungry Wall Street firms and funds.

Because of the ultra-rapid oil well depletion, when market oil prices collapse, the entire economics of lending to the shale oil drillers collapses as well. Money suddenly vanishes and debt-strapped oil companies begin real problems.

According to Philip Verleger, former head of President Carter’s Office of Energy Policy and now an energy consultant, in North Dakota’s Bakken shale, one of the most important new shale oil regions, oil at $70 a barrel could cut production 28 percent to 800,000 barrels a day by February from 1.1 million barrels a day in July.

“The cash flow will go down as the prices go down, the amount of money advanced to these people to continue the drilling will dry up entirely, so you’ll see a marked slowdown in drilling,” said Verleger.

Myths, Lies and Oil Wars

The end of the shale oil bubble would deal a devastating blow to the US oil geopolitics. Today an estimated 55% of US oil production and all the production increase of the past several years comes from fracking for shale oil. With financing cut off because of economic risk amid falling oil prices, shale oil drillers will be forced to halt new drilling that is needed merely to maintain a steady oil output.

The aggressive US foreign policy in the Middle East — its war against Syria’s al-Assad regime, its hardball oil sanctions against Iran, its sanctions against Russian oil projects, its cynical toleration of ISIS in Iraqi oil regions, its refusal to intervene to stabilize the Libyan oil economy but instead to tolerate dis-order are all premised on a cocky view in Washington that the USA is once again the King of Oil in the world and can afford to play high-risk oil geopolitics.

The official government agency responsible for advising the CIA, Department of Defense, State Department and White House on energy, the US Department of Energy, has issued projections of US shale oil growth based on myths and lies.

That has led the Obama White House to launch oil wars based on those same myths and lies about the rosy prospects of shale oil.

This oily arrogance was epitomized in a speech by then-Obama National Security Adviser Tom Donilon. In an April 2013 speech at Columbia University, Donilon, then Obama’s national security adviser, publicly expressed this:

“America’s new energy posture allows us to engage from a position of greater strength. Increasing US energy supplies acts as a cushion that helps reduce our vulnerability to global supply disruptions and price shocks. It also affords us a stronger hand in pursuing and implementing our international security goals.” The next three or so months in the US shale oil domain will be strategic.

F. William Engdahl, a strategic risk consultant and lecturer, holds a degree in politics from Princeton University and is a best-selling author on oil and geopolitics; exclusively for the online magazine “New Eastern Outlook”.

Editing: Jim W. Dean and Erica P. Wissinger

Frederick William Engdahl (born August 9, 1944) is an American writer, economics researcher, historian, and freelance journalist.

He is the author of the best-selling book on oil and geopolitics, A Century of War: Anglo-American Oil Politics and the New World Order. It has been published as well in French, German, Chinese, Russian, Czech, Korean, Turkish, Croatian, Slovenian, and Arabic. In 2010 he published Gods of Money: Wall Street and the Death of the American Century, completing his trilogy on the power of oil, food, and money control.

Mr. Engdahl is one of the more widely discussed analysts of current political and economic developments, and his provocative articles and analyses have appeared in numerous newspapers and magazines and well-known international websites. In addition to discussing oil geopolitics and energy issues, he has written on issues of agriculture, GATT, WTO, IMF, energy, politics, and economics for more than 30 years, beginning the first oil shock and world grain crisis in the early 1970s. His book, ‘Seeds of Destruction: The Hidden Agenda of Genetic Manipulation has been translated into eight languages. A new book, Full Spectrum Dominance: Totalitarian Democracy in the New World Order describes the American military power projection in terms of geopolitical strategy. He won a ‘Project Censored Award’ for Top Censored Stories for 2007-08.

Mr. Engdahl has lectured in economics at the Rhein-Main University in Germany and is a Visiting Professor in Economics at Beijing University of Chemical Technology.

After a degree in politics from Princeton University (USA), and graduate study in comparative economics at the University of Stockholm, he worked as an independent economist and research journalist in New York and later in Europe, covering subjects including the politics of energy policy in the USA and worldwide; GATT Uruguay Round trade talks, EU food policies, the grain trade monopoly, IMF policy, Third World debt issues, hedge funds, and the Asia crisis.

Engdahl contributes regularly to a number of international publications on economics and political affairs including Asia Times, FinancialSense.com, 321.gold.com, The Real News, Russia Today TV, Asia Inc., GlobalResearch.com, Japan’s Nihon Keizai Shimbun, Foresight magazine. He has been a frequent contributor to the New York Grant’sInvestor.com, European Banker and Business Banker International and Freitag and ZeitFragen in Germany, Globus in Croatia. He has been interviewed on various geopolitical topics on numerous international TV and radio programs including Al Jazeera, CCTV and Sina.com (China), CCTV (China) Korea Broadcasting System (KBS), and RT Russian TV. He is a Research Associate of Michel Chossudovsky’s well-respected Centre for Research on Globalization in Montreal, Canada, and a member of the editorial board of Eurasia magazine.

Mr. Engdahl has been a featured speaker at numerous international conferences on geopolitical, GMO, economic, and energy subjects. Among them is the Ministry of Science and Technology Conference on Alternative Energy, Beijing; London Centre for Energy Policy Studies of Hon. Sheikh Zaki Yamani; Turkish-Eurasian Business Council of Istanbul, Global Investors’ Forum (GIF) Montreaux Switzerland; Bank Negara Indonesia; the Russian Institute of Strategic Studies; the Chinese Ministry of Science and Technology (MOST), Croatian Chamber of Commerce and Economics.

He currently lives in Germany and, in addition to teaching and writing regularly on issues of international political economy and geopolitics, food security, economics, energy, and international affairs, is active as a consulting political risk economist for major European banks and private investors. A sample of his writings is available at Oil Geopolitics.net

ATTENTION READERS

We See The World From All Sides and Want YOU To Be Fully InformedIn fact, intentional disinformation is a disgraceful scourge in media today. So to assuage any possible errant incorrect information posted herein, we strongly encourage you to seek corroboration from other non-VT sources before forming an educated opinion.

About VT - Policies & Disclosures - Comment Policy

![washington-dc-white-house-s[1]](https://www.veteranstodayarchives.com/wp-content/uploads/2012/04/washington-dc-white-house-s1-e1334452207239.jpg)