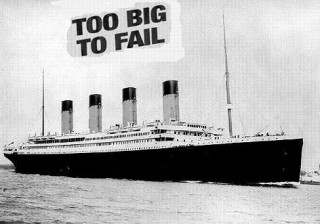

[T]here remains sharp disagreement on what exactly would end too big to fail. The main views fall primarily into three camps.

The view of Senator Dodd, Democratic congressional leadership more broadly, and the White House – and actually the big banks themselves (e.g., Jamie Dimon in Wednesday’s Wall Street Journal) – is that the creation of a “resolution authority” would, at a stroke, effectively remove the perception and the reality that some banks are too big to fail. The basic idea here – as elaborated on by Sheila Bair this week – is that the Federal Deposit Insurance Corporation (or potentially another agency) would expand the powers it currently has to “resolve” – i.e., takeover and liquidate in an orderly manner – banks with federally insured deposits; in the future, it could do this for any financial institution.

The view of leading Republicans is that the Dodd-Dimon approach would just formalize the existence of TBTF banks. Peter Wallison and David Skeel, for example, argue strongly that the FDIC has no competence in winding down large complex financial institutions – and they are certainly correct that this task would be quite different from closing small or medium-sized banks while protecting depositors. But their proposal – which seems to also have the support of Senator Richard Shelby (ranking Republican on the Senate Finance Committee) is that we should just allow big financial firms to fail outright, i.e., to run through the usual bankruptcy procedures.

At a rhetorical level, “let ‘em fail” has some appeal. But as a practical matter, it is a complete nonstarter. Remember that when Treasury Secretary Hank Paulson decided to let Lehman fail in September 2008, credit markets immediately choked and the global economy teetered on the brink of a Second Great Depression.

When another mega-bank starts to meltdown, any future president – no matter how libertarian or interventionist by inclination – will face the same horrible moment of decision: Let the financial system collapse or provide an expensive rescue. It is striking in this context that Mr. Wallison and others from the right used to be outspoken proponents of downsizing financial institutions that had become so large that they were assessed (correctly, as it turns out) Too Big To Fail – but that was when the debate was about Fannie Mae and Freddie Mac.

The third approach, articulated most clearly so far within the Senate by Ted Kaufman (D., DE) is much simpler and more direct: Break up these mega-banks. As even Alan Greenspan said in October 2009, “If they’re too big to fail, they’re too big” (see Chapter 9 of 13 Bankers).

There is no evidence for economies of scale or scope – or other social benefits – from banks with assets above $100 bn. Yet our largest banks have balance sheets around $2 trillion and Mr. Dimon defiantly affirmed last week – in his letter to shareholders – that JP Morgan Chase should be allowed to grow bigger, if it so pleases. But any such growth would not be outcome of any fair or normal market process. Rather it would reflect the Too Big To Fail implicit subsidy on which Mr. Dimon can now draw, manifest in the form of lower funding costs.

Mr. Dimon may or may not be a good manager of risk, but he will not run JP Morgan Chase for all time. Sooner or later, one or more our biggest banks will run into serious trouble.

And at that moment, it will matter a great deal whether “biggest bank” means assets of 2-4 percent of GDP (as we propose) or 20 percent of GDP (roughly our current situation) or over 100 percent of GDP (the problem of RBS, the largest UK bank, which essentially failed in 2008).

Making our largest banks smaller is not sufficient to ensure financial stability. As we review in 13 Bankers, there are many other complementary measures that make sense – including higher capital requirements, more transparency for derivatives, and generally more effective regulation. But reducing the size of our largest banks is absolutely necessary if we are to reduce the odds of another major financial catastrophe.

Make our largest banks small enough to fail. There is simply no other way to really end the problem of Too Big To Fail.

ATTENTION READERS

We See The World From All Sides and Want YOU To Be Fully InformedIn fact, intentional disinformation is a disgraceful scourge in media today. So to assuage any possible errant incorrect information posted herein, we strongly encourage you to seek corroboration from other non-VT sources before forming an educated opinion.

About VT - Policies & Disclosures - Comment Policy